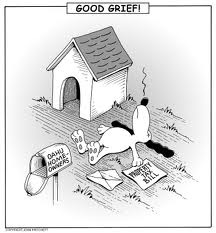

Homestead Tax Exemption

Posted by Boca Expert Realty on

Property Tax Exemption for Homestead Property - What is it?

If you own property in Florida as a permanent residence, then you may be eligible to receive a homestead exemption. The homestead exemption, in most cases, grants an $50,000 exemption from the assessed value of your house for tax purposes. This valuable benefit could save you close to $1,000 per year in property taxes. Additionally, the assessed value (the value the Property Appraiser uses to calculate the property tax) of your home cannot increase by more than 3% per year.

If you own property in Florida as a permanent residence, then you may be eligible to receive a homestead exemption. The homestead exemption, in most cases, grants an $50,000 exemption from the assessed value of your house for tax purposes. This valuable benefit could save you close to $1,000 per year in property taxes. Additionally, the assessed value (the value the Property Appraiser uses to calculate the property tax) of your home cannot increase by more than 3% per year.

What you need to file

For first time filers, the deadline to file is March 1 for that year's taxes. Once you are granted Homestead Exemption, it automatically renews. You should be prepared to answer these questions:…

2264 Views, 0 Comments

Beginning Monday, August 23, 2010, the Palm Beach County Property Appraiser’s office mailed the proposed property taxes for 2010. In the notice, there is a breakdown of millage rates , the property’s assessed and taxable values (as of January 1, 2010), and any exemptions applied. Read your notice closely. Although unfortunately millage rates have gone up in most areas, the values have declined. (example: I am an owner of Boca Raton Real Estate. My market value declined 10%, however my tax bill increased because the local taxing authorities increased their millage rate.) If you disagree with the value, or an exemption has not been applied, you have between now and September 16, 2010 to file a petition. With property values plummeting in the area, many…

Beginning Monday, August 23, 2010, the Palm Beach County Property Appraiser’s office mailed the proposed property taxes for 2010. In the notice, there is a breakdown of millage rates , the property’s assessed and taxable values (as of January 1, 2010), and any exemptions applied. Read your notice closely. Although unfortunately millage rates have gone up in most areas, the values have declined. (example: I am an owner of Boca Raton Real Estate. My market value declined 10%, however my tax bill increased because the local taxing authorities increased their millage rate.) If you disagree with the value, or an exemption has not been applied, you have between now and September 16, 2010 to file a petition. With property values plummeting in the area, many…