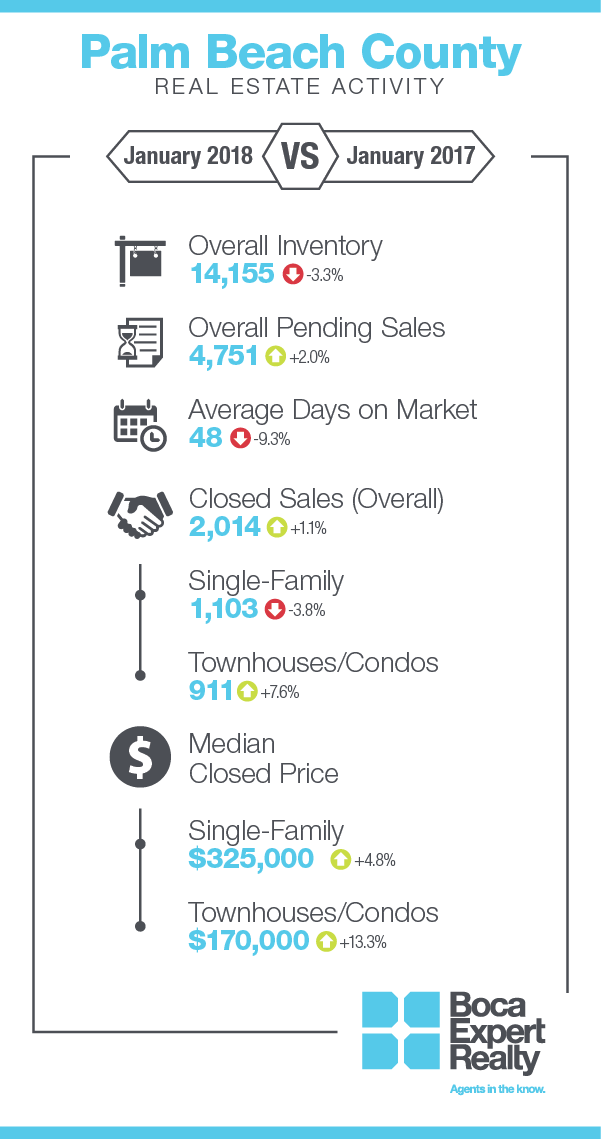

Palm Beach County’s housing market reported rising median prices and reduced listing inventory in January 2018 as compared to January 2017, according to the latest housing data released by Florida Realtors®.

Here’s what buyers and sellers of Boca Raton real estate need to know.

Median Price Ticks Upward

January marked 73 consecutive months that the median sales prices for both single-family homes and townhouse-condos rose year-over-year. The median price is the midpoint, meaning half the homes sold for more, half for less. Months supply of inventory is only 5 months for single-family homes and 6 months for condo and townhouses.

Shrinking Inventory Putting Pressure on Buyers

In many sub-markets, particularly those below the $500,000 price range, there is an ongoing shortage of housing inventory. January’s numbers reflect the tight supply, which when combined with the rising median prices puts pressure on potential homebuyers.

Additionally, fixed mortgage rates have ticked up now for seven consecutive weeks. According to Freddie Mac, the average 30-year fixed rate now stands at 4.4 percent, the highest it has been since April 2014. Mortgage rates have followed U.S. Treasury rates, rising higher in anticipation of increased inflation and further monetary tightening by the Federal Reserve. If those increases become reality, we will likely see mortgage rates continue to trend higher. Although in our marketplace close to 50 percent of sales are cash sales, this further disadvantages younger and first-time buyers trying to get a foothold in our competitive market.

Ready to Buy or Sell in South Florida?

I’m always here to help you navigate the local market. Contact me today for a customized look at the latest conditions for the Boca Raton real estate market and beyond.

Posted by Gloria Singer on

Leave A Comment