Newly released market statistics from Florida Realtors® are in, showing recent real estate market activity in our area. The reports compare year over year data for the month of June. Read on to learn more about the real estate market in South Palm Beach County:

Newly released market statistics from Florida Realtors® are in, showing recent real estate market activity in our area. The reports compare year over year data for the month of June. Read on to learn more about the real estate market in South Palm Beach County:

Interest Rates

As was widely expected, the Federal Reserve did not change the target range for the federal funds rate – currently set at 2.25 to 2.5 percent – during their June meeting. Although the economy is still performing well due to factors such as low unemployment and solid retail sales, uncertainty remains regarding trade tensions, slowed manufacturing and meek business investments. According to Freddie Mac, the interest rate for a 30-year fixed-rate mortgage averaged 3.80% in June 2019, down from the 4.57% averaged during the same month a year earlier.

Existing Home Sales Falter

The number of total sales for June is down 10.5% year over year, and down 8.2% on a year-to-date basis. “Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country,” said Lawrence Yun, NAR’s chief economist. Yun says the nation is in the midst of a housing shortage and much more inventory is needed. “Imbalance persists for mid-to-lower priced homes with solid demand and insufficient supply, which is consequently pushing up home prices,” he said.

Yun said other factors could be contributing to the low number of sales. “Either a strong pent-up demand will show in the upcoming months, or there is a lack of confidence that is keeping buyers from this major expenditure. It’s too soon to know how much of a pullback is related to the reduction in the homeowner tax incentive.”

Total Market Overview

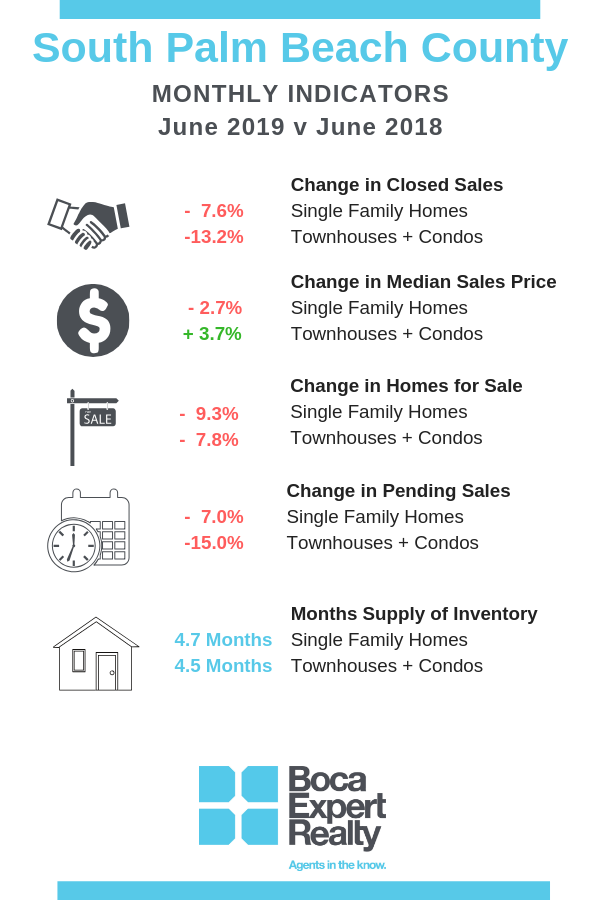

New Listings decreased 5.3 percent for Single Family homes and 5.5 percent for Townhouse/Condo homes. Pending Sales decreased 7.0 percent for Single Family homes and 15.0 percent for Townhouse/Condo homes. Inventory decreased 9.3 percent for Single Family homes and 7.8 percent for Townhouse/Condo homes. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two, so it is possible that we will continue to see closed sales decline. Median Sales Price decreased 2.7 percent to $365,000 for Single Family homes but increased 3.7 percent to $183,000 for Townhouse/Condo homes. Median Time to Contract increased 25.0 percent for Single Family homes but decreased 2.5 percent for Townhouse/Condo homes. Months Supply of Inventory decreased 7.8 percent for Single Family homes and 4.3 percent for Townhouse/Condo homes.

What is to come?

In terms of relative balance between buyer and seller interests, residential real estate markets across the country are performing well within an economic expansion that will become the longest in U.S. history in July. However, there are signs of a slowing economy. The Federal Reserve considers 2.0 percent a healthy inflation rate, but the U.S. is expected to remain below that this year. The Fed has received pressure from the White House to cut rates in order to spur further economic activity, and the possibility of a rate reduction in 2019 is definitely in play following a string of increases over the last several years.

Want to know more?

I’m always here to help you navigate the local market. I can analyze the specific neighborhood and price range for you, whether you are interested in buying or in selling. Contact me today for a customized look at the latest conditions for the Boca Raton real estate market and beyond.

Posted by Gloria Singer on

Leave A Comment