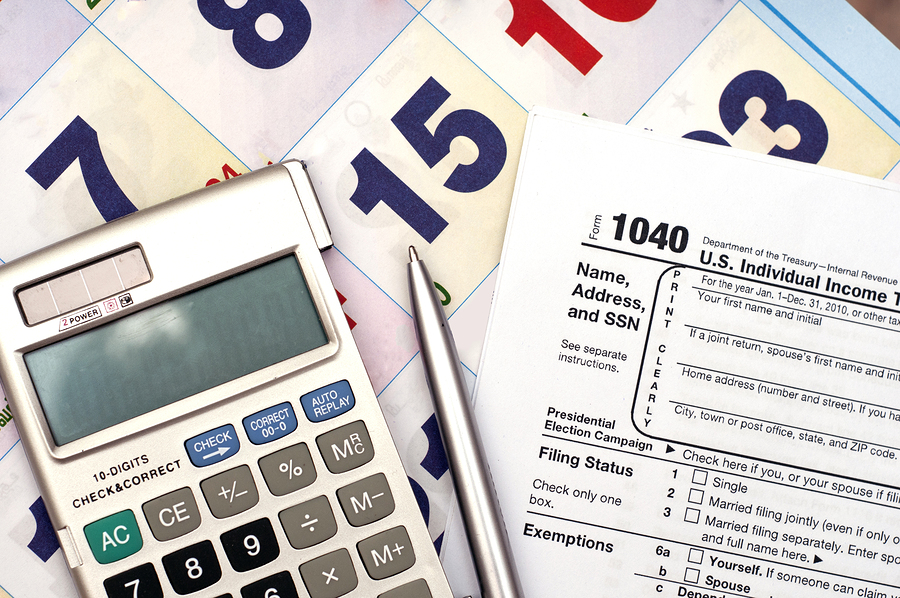

As the House and Senate inch closer to reconciling their differences and passing a sweeping tax reform bill, there are many proposals that will have a huge impact on real estate.

As the House and Senate inch closer to reconciling their differences and passing a sweeping tax reform bill, there are many proposals that will have a huge impact on real estate.

Exemption from Gain on Sale

Currently, there is an exclusion from capital gains of $250,000 for singles and $500,000 for married couples filing jointly if you have lived in the home as your primary residence for two of the past five years. The new bill most likely will change this to retain the exclusion amount but to require you to live in your home for five out of the past eight years in order to receive the tax break. Since people move on average every seven years, this won’t affect the average American taxpayer. But for people that must sell, for instance, due to a job transfer or a divorce, this change could present some obstacles.

UPDATE 12/18/2017: The final bill apparently will not be changing this Exclusion even though both the Senate and House versions had it. I guess the Realtor lobby got this win!

Deductibility of Mortgage Interest

The new bill proposes limiting the deduction for mortgage interest to loan amounts up to $750,000. Since the standard deduction is almost doubling to $24,000 for couples, many people will not be able to take advantage of the mortgage interest deduction.

SALT Deductions

Currently, for those that itemize their deductions, they can deduct all state and local income taxes paid as well as property taxes and in some cases sales tax. Since in Florida we don’t have state income taxes, we are only affected by the limitation on property tax. The bill is proposing limiting the property tax deduction to $10,000 a year. So again, because of the increased standard deduction, I’m not sure many people will benefit from this.

Final Thoughts

The National Association of Realtors is lobbying strongly against any limits on deductibility, but I’m not sure it really will make any difference. Their argument is that if the cost of home ownership goes up (as a result of limiting deductions), that therefore home values will come down. They say that this will hurt many middle-income people who will lose home equity. I am not sure I agree with this reasoning. And if, as they say, there is a concern for middle-income people, then according to their logic, if home values do decline, more people would be able to afford homes. If that happened, then theoretically the rate of homeownership would increase. They also claim that fewer people will be homeowners. Many countries do not have income tax deductions for mortgage interest and their homeownership rates are at least as high as ours. I do think this will be an adjustment, but long term I don’t believe that limiting these deductions, especially if they are offset by a larger standard deduction for all (both homeowners and renters) will be detrimental to home values or the ideal of home ownership.

I think that the more significant impact of this legislation will be the SALT deductions rather than mortgage interest, especially in our local market. We are already fielding calls from residents of high-income tax states who are looking to relocate to Florida and avoid paying state and local income taxes altogether as a result of this new bill.

In my opinion, there are many things to be concerned about in this new tax bill, but as far as its impact on our local real estate market, I do not expect any significant changes.

Leave A Comment